Hey, it’s Summer — founder of the Red Light Green Light Newsletter.

This special edition recaps what worked in 2025, the risks emerging beneath the surface, and the stocks I’m buying next.

2025 US Equity Market Recap

Price | YTD return | |

|---|---|---|

S&P500 | $6,905.75 | +17.41% |

NASDAQ | $23,474.35 | +22.18% |

Dow Jones | $48,461.93 | +14.05% |

Gold | $4,377.63 | +66.01% |

Silver | $75.09 | +149.95% |

Bitcoin | $87,376.08 | -7.49% |

Data is provided by Google Finance & Seeking Alpha

*Stock data as of market close on Dec 29th, cryptocurrency and gold data as of Dec 29th 12:00am ET

The bull market that began in 2023 extended into 2025, but returns were increasingly uneven. US equities posted solid gains, with the S&P 500 up ~17% and the NASDAQ leading at ~22%, reflecting continued strength in large-cap tech. Outside equities, performance diverged sharply: gold surged ~66% and silver nearly 150%, while Bitcoin finished the year down ~7%. Rather than a broad risk-on rally, 2025 rewarded selective positioning, with capital concentrating in a handful of leaders and hard assets instead of lifting all boats.

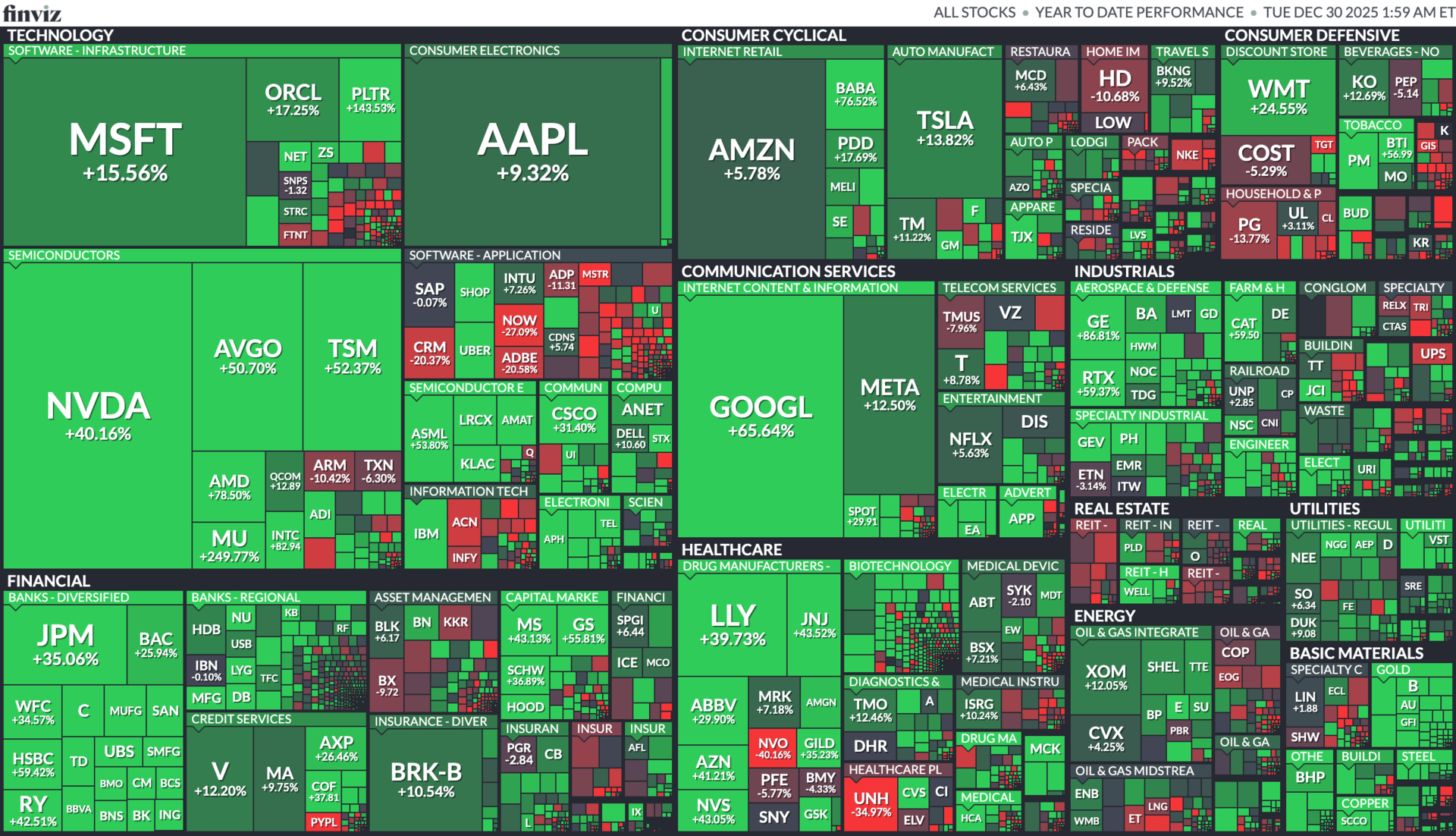

Sector Snapshot

The 2025 sector heat map confirms that market gains were driven by a small group of leaders rather than broad participation. Within the Magnificent 7, performance was highly uneven: Google (+65.6%) and NVIDIA (+40.16%) clearly led, powered by AI infrastructure, cloud, and advertising momentum. The rest of big tech delivered more modest returns — Tesla (+13.8%), Microsoft (+15.6%), Meta (+12.5%) tracked closer to the index, while Apple (+9.3%) and Amazon (+6.0%) lagged, reflecting slower growth expectations and margin pressure. Outside big tech, semiconductors and AI-linked hardware showed strength, while financials, healthcare, and industrials were mixed.

The takeaway is simple: 2025 rewarded concentration and selectivity, not broad sector exposure.

Looking Ahead to 2026

Looking ahead to 2026, AI remains the core market driver, with leadership still concentrated rather than broad-based. The strongest tailwinds continue to sit in nuclear energy (powering AI), semiconductors—especially advanced packaging and testing—and the Magnificent 7, which remain best positioned to convert AI investment into earnings at scale. For the rest of the market, performance will likely be conditional, not universal: sectors and companies that meaningfully integrate AI into productivity, margins, or business models can outperform, while those that don’t may struggle to keep up. This is less about sector rotation and more about AI adoption quality.

At the same time, I expect a market correction within the next three months, driven by a fragile setup: rising hedging activity, a widening gap between AI expectations and the real economy, shifting global capital flows, and tighter policy out of Japan increasing short-term volatility. Importantly, this isn’t a bearish call—it’s about preparation. Any pullback should be viewed as an opportunity, not a threat, to selectively add exposure to high-conviction AI-linked themes and leaders. Risk management creates flexibility, and flexibility is what allows capital to be deployed when the market resets.

Stocks I’m buying to outperform the market in 2026

Micron Technology ( $MU ( ▲ 5.53% ) )

AI data centres are driving structural demand for DRAM and HBM

Tight supply supports pricing power and margin expansion

Earnings recovery not fully reflected in valuation

Teradyne ( $TER ( ▲ 0.44% ) )

AI chips require more complex and frequent testing

Mission-critical position in advanced chip manufacturing

Leverage to AI capex without taking chip design risk

Amazon ( $AMZN ( ▲ 0.44% ) )

AWS remains a long-term AI and cloud growth engine

Stock lagged in 2025, creating a valuation reset

Advertising and cloud margins drive cash-flow upside

Centrus Energy ( $LEU ( ▲ 6.97% ) )

Only US producer licensed for HALEU nuclear fuel

Direct beneficiary of SMRs and nuclear restarts

Backed by government contracts and strategic importance

Taiwan Semiconductor Manufacturing Company ( $TSM ( ▲ 1.77% ) )

Dominant supplier of advanced AI chips (3nm/2nm)

Strong pricing power through scale and technology lead

Core infrastructure play for the entire AI ecosystem

Winning “Brewery of the Year” Was Just Step One

Coveting the crown’s one thing. Turning it into an empire’s another. So Westbound & Down didn’t blink after winning Brewery of the Year at the 2025 Great American Beer Festival. They began their next phase. Already Colorado’s most-awarded brewery, distribution’s grown 2,800% since 2019, including a Whole Foods retail partnership. And after this latest title, they’ll quadruple distribution by 2028. Become an early-stage investor today.

This is a paid advertisement for Westbound & Down’s Regulation CF Offering. Please read the offering circular at https://invest.westboundanddown.com/

Disclaimer: The information provided in this newsletter is for educational and informational purposes only and should not be construed as investment advice. I am not a licensed financial advisor, and the opinions expressed here are based on my personal research and portfolio decisions. Investing in securities involves risk, including the potential loss of principal. Past performance is not indicative of future results. Always do your own research or consult with a licensed financial professional before making investment decisions.