Markets kicked off the year strong, but beneath the surface, risk appetite is rising fast. This week’s issue looks at what’s really driving the rally—and where speculation may be getting ahead of fundamentals.

Market Overview — (Jan 5 - 9, 2026)

Price | Weekly Change | |

|---|---|---|

S&P500 | $6,966.28 | +1.01% |

NASDAQ | $23,702.88 | +1.35% |

Dow Jones | $49,504.07 | +1.37% |

10 Year Interest Rate | 4.171% | -0.29% |

Bitcoin | $90,500 | -2.27% |

Gold | $4,510.81 | +3.61% |

VIX ( Volatility Index) | 14.29 | -4.29% |

Data is provided by Google Finance & Seeking Alpha

*Stock data as of market close, cryptocurrency and gold data as of Friday 6:00pm ET

This week saw a broad-based rally across U.S. equities, with the S&P 500 up 1.0%, the Nasdaq gaining 1.35%, and the Dow leading with a 1.37% advance. The move higher was supported by a slight pullback in the 10-year Treasury yield, easing pressure on risk assets and helping sentiment stay constructive.

At the same time, volatility continued to compress, with the VIX falling to 14.29, signaling calmer market conditions. Bitcoin pulled back over the week, while gold surged 3.6%, suggesting investors are still selectively hedging despite equity strength. Overall, the setup points to a risk-on environment, but with capital rotating rather than chasing everything indiscriminately.

Sector Snapshot

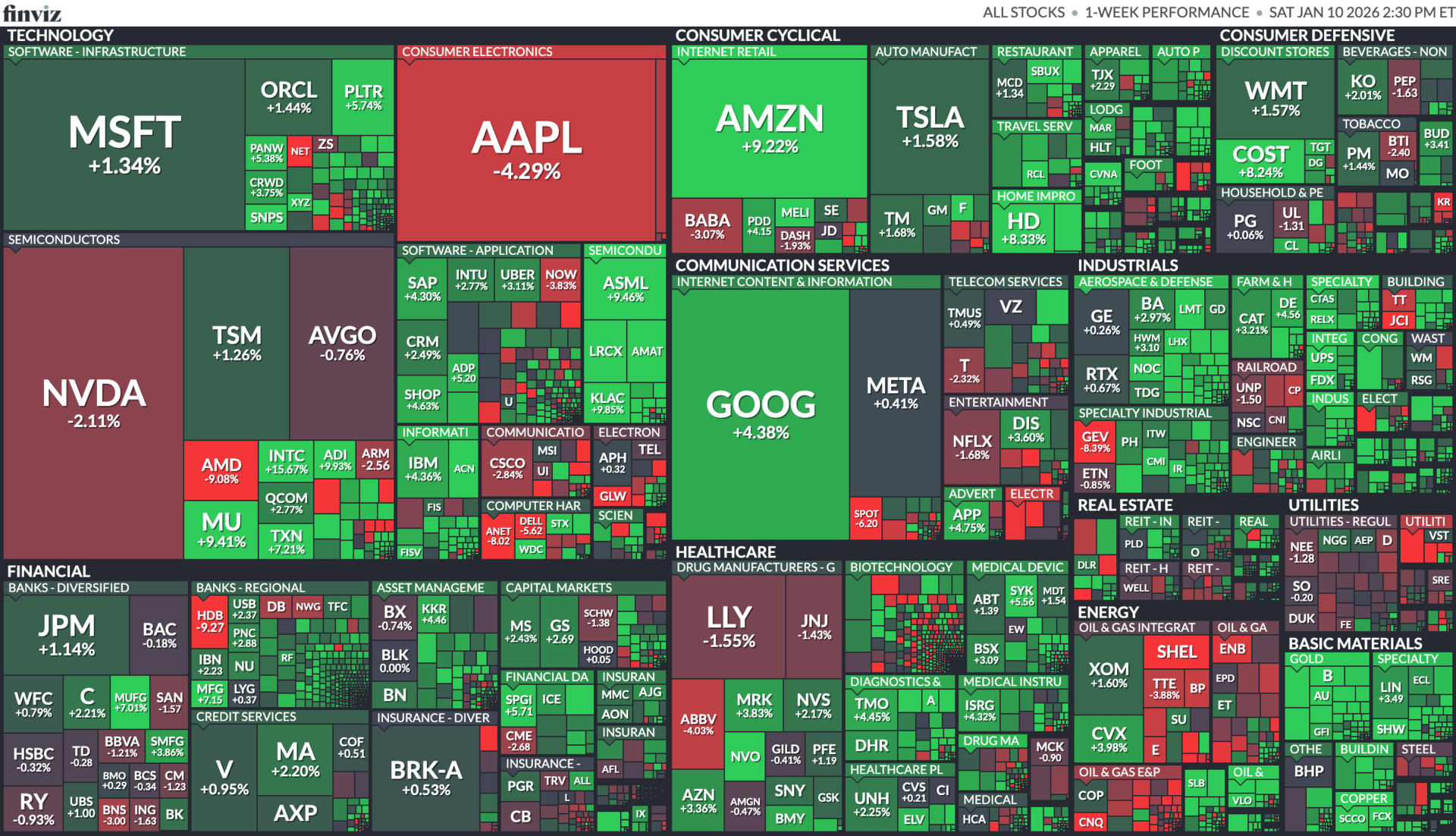

Sector performance this week was selectively risk-on, with strength concentrated in communication services, consumer discretionary, and select industrials, while parts of big tech and semiconductors lagged. Mega-cap dispersion remained clear: AMZN and GOOGL outperformed, reflecting renewed confidence in consumer spending and digital advertising, while AAPL and NVDA pulled back, weighing on the broader tech complex. Financials were mixed but stable, and defensives quietly held their ground, suggesting investors are rotating rather than de-risking outright.

Biggest Movers This Week (Market Cap $10B+)

Top Gainers 📈

Amazon (AMZN) +9.2% – Strong rebound driven by optimism around consumer demand and operating leverage in retail and cloud.

Alphabet (GOOGL) +4.4% – Continued momentum as advertising trends stabilize and AI monetization remains in focus.

Micron (MU) +9.4% – Benefited from renewed confidence in the memory cycle and AI-driven demand outlook.

Top Decliners 📉

Apple (AAPL) −4.3% – Pulled back on near-term growth concerns and valuation pressure after a strong prior run.

NVIDIA (NVDA) −2.1% – Consolidation following recent gains as investors reassess AI infrastructure pacing.

AMD −9.1% – Sharper drawdown tied to competitive concerns and profit-taking in semiconductors.

Wall Street Isn’t Warning You, But This Chart Might

Vanguard just projected public markets may return only 5% annually over the next decade. In a 2024 report, Goldman Sachs forecasted the S&P 500 may return just 3% annually for the same time frame—stats that put current valuations in the 7th percentile of history.

Translation? The gains we’ve seen over the past few years might not continue for quite a while.

Meanwhile, another asset class—almost entirely uncorrelated to the S&P 500 historically—has overall outpaced it for decades (1995-2024), according to Masterworks data.

Masterworks lets everyday investors invest in shares of multimillion-dollar artworks by legends like Banksy, Basquiat, and Picasso.

And they’re not just buying. They’re exiting—with net annualized returns like 17.6%, 17.8%, and 21.5% among their 23 sales.*

Wall Street won’t talk about this. But the wealthy already are. Shares in new offerings can sell quickly but…

*Past performance is not indicative of future returns. Important Reg A disclosures: masterworks.com/cd.

Markets News

Oil rises as markets assess supply risks tied to Venezuela

Crude gained as traders priced uncertainty around Venezuelan supply, making Venezuela a live variable again for oil direction and energy equities.The stock-market rally isn’t just about tech anymore

WSJ highlights a shift toward sectors tied to the broader economy as investors get more selective on AI exposure and look for cheaper parts of the market.China to scrap export tax rebates for photovoltaic and battery products

Beijing is dialling back export support amid overcapacity and price wars, a meaningful headline for global solar and battery supply chains.Dow closes above 49,000 for first time as rally broadens beyond tech

The early-2026 move has been more about sector rotation than pure mega-cap tech, with strength showing up in areas like healthcare, materials, and defence.Asia stocks surge as Nikkei hits a record and KOSPI pushes deeper into record territory

Japan’s Nikkei rose about 1.3%, South Korea’s KOSPI gained about 1.5%, and Hong Kong’s Hang Seng jumped about 1.4%, reflecting strong risk appetite in North Asia to start the year.

My Take for This Week 📝

This week reinforced a familiar theme: the market is rotating, not retreating. With major indexes pushing higher and volatility staying compressed, capital is moving selectively rather than exiting risk altogether. Strength in large-cap names with clearer earnings visibility contrasts with consolidation in prior leaders, highlighting a more discriminating tape.

One development worth flagging is the surge in trading volume across speculative pockets. We’re seeing unusually high activity in stocks with weak or unproven fundamentals, such as $ONDS ( ▲ 1.44% ) and parts of the quantum computing space. Historically, this kind of behaviour tends to show up late in the cycle, when greed starts to outweigh discipline. It doesn’t mean the market has to roll over immediately, but it does suggest we may be approaching a more fragile phase, where risk management matters more than chasing upside.

Weekly Poll 🗳️

Have you ever used a prediction market (e.g. Polymarket, Kalshi)?

Last week’s Result:

What’s your biggest concern for markets in 2026

Most popular answer: Valuations (50%)

Run ads IRL with AdQuick

With AdQuick, you can now easily plan, deploy and measure campaigns just as easily as digital ads, making them a no-brainer to add to your team’s toolbox.

You can learn more at www.AdQuick.com

Disclaimer: The information provided in this newsletter is for educational and informational purposes only and should not be construed as investment advice. I am not a licensed financial advisor, and the opinions expressed here are based on my personal research and portfolio decisions. Investing in securities involves risk, including the potential loss of principal. Past performance is not indicative of future results. Always do your own research or consult with a licensed financial professional before making investment decisions.