Hey it’s Summer! Happy Halloween 🎃

Markets had their own tricks and treats this week: AI hype lifted tech, but the Fed’s cautious tone kept investors on edge. With OpenAI’s IPO buzz and gold pulling back, the rally’s still alive — just don’t get fooled by the mask it’s wearing.

Market Overview — (Oct 27 – 31, 2025)

Price | Weekly Change | |

|---|---|---|

S&P500 | $6,840.20 | -0.08% |

NASDAQ | $23,724.96 | +0.8% |

Dow Jones | $47,562.87 | +0.32% |

10 Year Interest Rate | $4.101 | +2.6% |

Bitcoin | $109,696.90 | -4.13% |

Gold | $4,001.60 | -2.3% |

Data is provided by Google Finance

*Stock data as of market close, cryptocurrency and gold data as of Friday 9:00pm ET

This week showed mixed signals across the three major indexes. The S&P 500 dipped slightly by 0.08%, while the Nasdaq gained 0.8% and the Dow Jones rose 0.32%. The divergence was largely driven by earnings reports from major companies, which fueled stronger momentum in the Nasdaq but not in the broader S&P 500.

Bitcoin continued its recent downtrend, falling 4.1% as investor risk appetite weakened amid broader market caution. Gold also dropped 2.3%, hovering around $4,000 per ounce after retreating from its all-time high near $4,365.

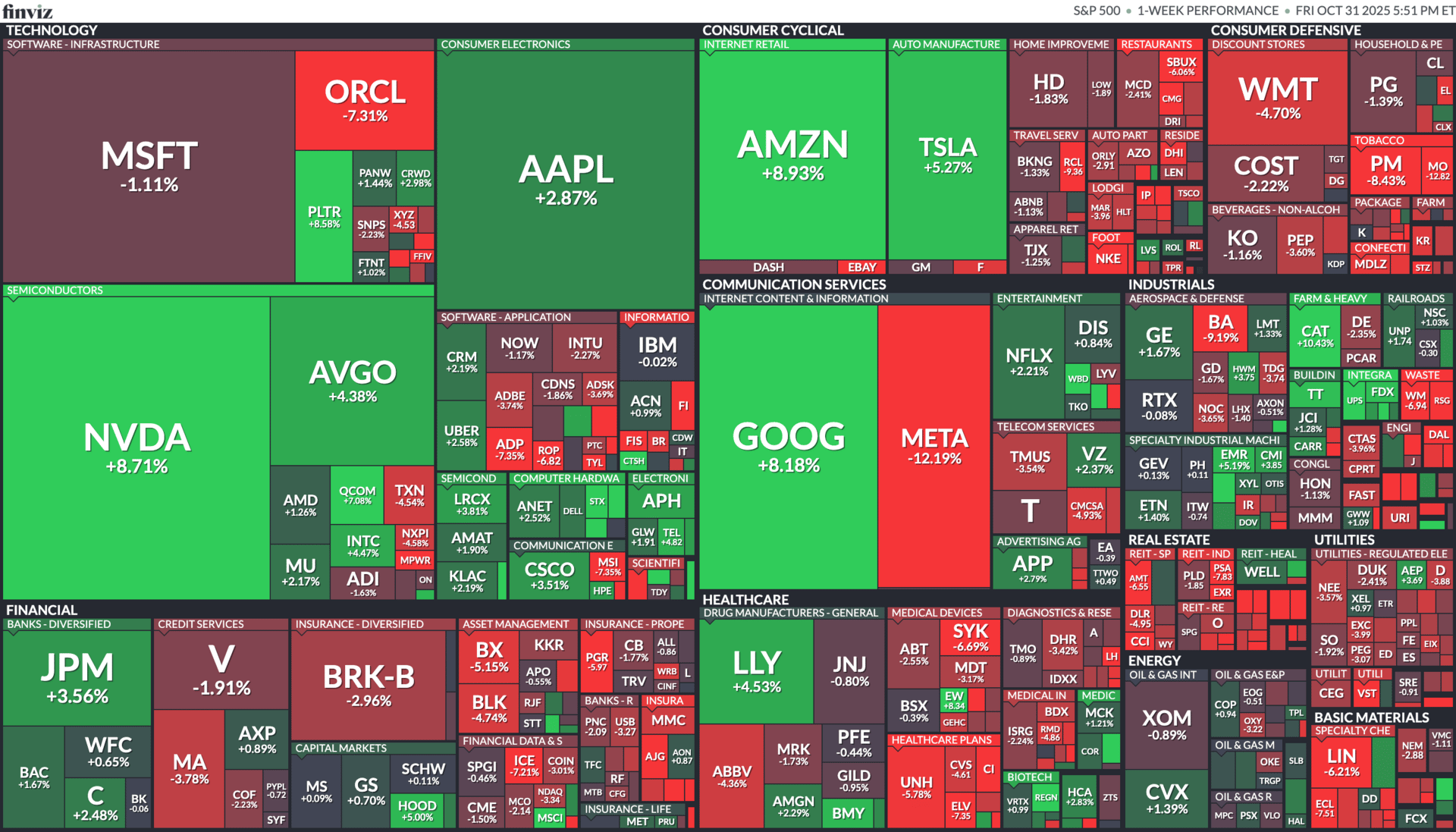

Sector Snapshot

AI-linked mega caps powered the rally: Nvidia, Google, and Amazon all gained over 8%, while Meta’s 12% drop capped tech’s upside. Defensive names like Walmart and Procter & Gamble lagged as investors rotated back into growth.

Reddit’s Top Stocks Beat the S&P by 40%

Buffett-era investing was all about company performance. The new era is about investor behavior.

Sure, you can still make good returns investing in solid businesses over 10-20 years.

But in the meantime, you might miss out on 224.29% gainers like Robinhood (the #6 most-mentioned stock on Reddit over the past 6 months).

Reddit's top 15 stocks gained 60% in six months. The S&P 500? 18.7%.

AltIndex's AI processes 100,000s of Reddit comments and factors them into its stock ratings.

We've teamed up with AltIndex to get our readers free access to their app for a limited time.

The market constantly signals which stocks might pop off next. Will you look in the right places this time?

Past performance does not guarantee future results. Investing involves risk including possible loss of principal.

US Markets 🇺🇸

OpenAI lays groundwork for juggernaut IPO at up to US$1 trillion valuation - The AI powerhouse is preparing to file for an IPO possibly as soon as second half of 2026, with a target valuation of up to US$1 trillion and a capital raise of ~$60 billion or more.

Stocks climb to record on US-China trade optimism - On Oct 27 U.S. markets (Dow, S&P 500, Nasdaq) hit record highs as optimism mounted for a trade-deal framework between the U.S. and China, which helped boost risk-appetite.

Wall Street scales record highs as Nvidia hits US$5 trillion valuation - On Oct 29 Nvidia became the first public U.S. company to top a US$5 trillion market cap, fueling the broader market’s rally amid the AI-spending boom.

S&P 500 & Nasdaq slide as Meta Platforms, Microsoft fall on AI-spending concerns - On Oct 30 the market pulled back: Meta dropped ~11 % (its biggest slump in years) and Microsoft fell ~2.3% after heavy investment guidance in AI, which spooked investors worried about return on investment.

Treasury sec. signals U.S. will balk at any dollar rebound - On Oct 30 Treasury Secretary Scott Bessent warned that the U.S. administration sees a strong dollar as detrimental to its trade/industrial agenda, signaling potential resistance to a major dollar upswing.

Global Markets 🌍

Global stocks rally on US-China trade optimism - Global equity markets surged — Japan’s Nikkei 225 broke above 50,000 and South Korea’s Kospi hit a record high — as progress toward a US-China trade framework boosted risk appetite worldwide.

European shares edge higher as trade hopes and earnings lift sentiment - The STOXX 600 reached a record intraday high, driven by strong tech and bank performances amid easing trade tensions and solid quarterly earnings reports.

Oil firm Petrofac enters administration amid broader global M&A activity- UK-based Petrofac filed for administration, putting 2,000 jobs at risk — highlighting the uneven recovery in energy and industrial sectors despite bullish equity markets.

Wall Street highs drive global shift away from safe havens like gold

Global capital flows favored equities as gold prices slid nearly 5%, signaling investors’ growing appetite for risk in response to easing inflation and trade progress.

Fact-based news without bias awaits. Make 1440 your choice today.

Overwhelmed by biased news? Cut through the clutter and get straight facts with your daily 1440 digest. From politics to sports, join millions who start their day informed.

My Take for This Week 📝

Markets ended the week mixed as investors balanced AI-driven optimism with Fed uncertainty. The Nasdaq outperformed with a 0.8% gain, fueled by Nvidia’s $5 trillion valuation and buzz around OpenAI’s potential $1 trillion IPO, while the S&P 500 and Dow moved only slightly. It’s clear that big tech continues to dominate market sentiment.

Globally, optimism from U.S.–China trade progress helped lift Asian and European markets to multi-year highs, but beneath the surface, investors are beginning to question how much AI growth is already priced in. When valuations start touching 40 to 50 times earnings, even a small disappointment in earnings or Fed policy could trigger sharp corrections.

In short, the market is still bullish — but fragile. As liquidity expectations drive prices upward, fundamentals are becoming stretched. I’d stay selective in high-growth names, maintain cash flexibility, and keep an eye on bond yields and Fed guidance, which could easily flip market sentiment heading into November.

Weekly Poll 🗳️

Last week’s Result:

What’s your outlook on the stock market for the next 6 months?

Most popular answer: Somewhat Bearish📉(83%)

AI You’ll Actually Understand

Cut through the noise. The AI Report makes AI clear, practical, and useful—without needing a technical background.

Join 400,000+ professionals mastering AI in minutes a day.

Stay informed. Stay ahead.

No fluff—just results.

Disclaimer: The information provided in this newsletter is for educational and informational purposes only and should not be construed as investment advice. I am not a licensed financial advisor, and the opinions expressed here are based on my personal research and portfolio decisions. Investing in securities involves risk, including the potential loss of principal. Past performance is not indicative of future results. Always do your own research or consult with a licensed financial professional before making investment decisions.