Hey, it’s Summer!

Markets paused after the Fed cut, but the bigger story this week was rotation—not panic. In this issue, we break down what’s driving the pullback, where capital is holding up, and how to think about positioning through volatility.

Market Overview — (Dec 8 – 12, 2025)

Price | Weekly Change | |

|---|---|---|

S&P500 | $6,827.41 | -0.62% |

NASDAQ | $23,195.90 | -1.94% |

Dow Jones | $48,458.05 | +1.31% |

10 Year Interest Rate | 4.194% | +1.13% |

Bitcoin | $90,293.40 | +0.88% |

Gold | $4,298.00 | +2.36% |

CBOE Volatility Index | 15.93 | -1.3% |

Data is provided by Google Finance

*Stock data as of market close, cryptocurrency and gold data as of Friday 6:00pm ET

This week delivered mixed signals across markets. The Dow Jones gained 1.3%, while the S&P 500 slipped 0.6% and the Nasdaq fell nearly 2%, reflecting a rotation away from high-growth tech. The late-week pullback was largely driven by Broadcom’s forward guidance, which pointed to a slower-than-expected rollout in AI data-center demand—tempering optimism despite the Fed’s rate cut on Wednesday.

Bitcoin continued to consolidate around the $90,000 level, showing resilience but little momentum. Gold climbed toward $4,300/oz, benefiting from renewed uncertainty around AI spending and longer-term growth expectations. Meanwhile, the VIX hovered around 16, a relatively normal level, suggesting that while sentiment has cooled, broader market volatility remains contained.

Sector Snapshot

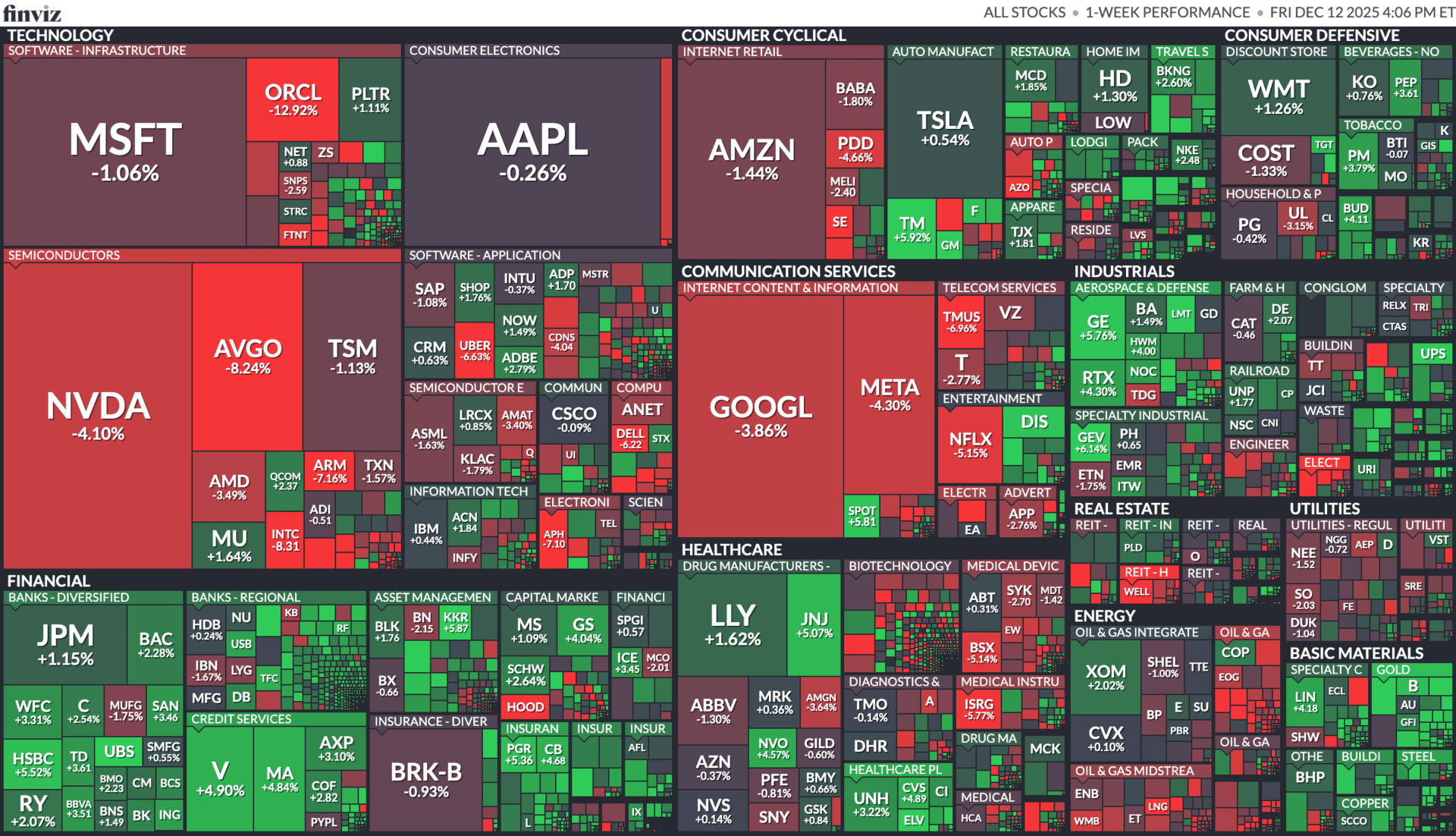

This week’s sector performance leaned risk-off, with mega-cap tech and semiconductors under pressure while defensives and select cyclicals held up better. AI-linked names lagged, led by NVDA (-4.1%), AVGO (-8.2%), MSFT (-1.1%), and GOOGL (-3.9%), reflecting investor caution after softer AI-infrastructure guidance.

Consumer cyclicals were mixed, with AMZN (-1.4%) weighing on the sector despite strength in autos like TSLA (+0.5%). Healthcare showed relative resilience—LLY (+1.6%) and JNJ (+5.1%) outperformed—signaling a mild rotation toward defensives. Financials held up well overall, with banks and asset managers posting modest gains, while energy and utilities were broadly stable amid subdued volatility.

US Markets 🇺🇸

Stocks rise, yields and dollar fall after Fed cuts interest rates

The Fed delivered another 25 bps cut and signalled a likely pause, sending major U.S. indexes higher while Treasury yields and the dollar slipped as markets priced in the chance of further easing in 2026.Oracle forecasts miss Wall Street targets while spending rises, shares slide 10%

Oracle’s weak outlook and heavier AI/data-centre capex rattled investors, wiping out ~10% of its market value and sparking broader worries about whether AI infrastructure spending will actually translate into profits.Tesla U.S. sales drop to nearly four-year low despite cheaper versions

November U.S. sales fell 23% YoY to the lowest level since early 2022, as Tesla’s new “Standard” trims cannibalized pricier models and overall EV demand softened after tax-credit changes.Cannabis stocks surge on report Trump seeks to ease restrictions

U.S.-listed cannabis names like $TLRY ( ▲ 0.55% ) and $CGC ( ▼ 4.65% ) jumped after reports that Trump is considering loosening federal restrictions, reviving hopes for banking access and broader legalization.

Are You Ready to Climatize?

Climatize hosts vetted renewable energy project offerings across the U.S., including solar installations, battery storage, energy efficiency upgrades, EV charging stations, and more.

Over $13.2M has been invested, and more than $3.6M returned to date. Returns not guaranteed. You can back up offerings from $10.

Climatize is an SEC-registered & FINRA member funding portal. Crowdfunding carries risk, including loss.

Global Markets 🌍

Investors bet Nvidia and Google will fuel Taiwan stocks to record highs

Taiwan’s market is expected to push toward 30,000 as local investors double down on TSMC and other AI hardware names, shrugging off global “AI bubble” worries even as foreign funds take profits.Europe's EV sector warns about efforts to dilute EU emissions targets

European automakers and suppliers say moves to soften 2030–2035 CO₂ rules and the effective 2035 combustion-engine ban risk undermining billions already committed to EVs and charging infrastructure.UAE stocks ease as oil slips and profit-taking caps Dubai rally

Dubai and Abu Dhabi indices pulled back as weaker oil prices and profit-taking hit recent winners, even as select financials and real-estate names stayed resilient.Global equity funds draw largest weekly inflow in five weeks

Investors poured $12.9B into global equity funds after the Fed cut, with Europe leading inflows and strong interest in metals & mining, utilities, and industrials; money market funds saw nearly $13B in outflows.

My Take for This Week 📝

This week felt less like panic and more like a reset in expectations. Despite the Fed cutting rates, markets were reminded that not every part of the AI trade moves in a straight line. The pullback in semiconductors and mega-cap tech looks driven more by forward guidance and positioning than any real deterioration in fundamentals, while the Dow’s strength and healthcare’s resilience suggest capital is rotating, not leaving the market.

Personally, I’m not rushing to sell into this weakness. Pullbacks like this are often where long-term opportunities are created, especially in high-quality companies with strong balance sheets and durable cash flows. I’ve started building positions selectively and plan to add further if volatility picks up, knowing that another few percent of downside in the broader market wouldn’t be surprising.

I’ll also continue to keep a close eye on the volatility index (VIX). As long as volatility stays contained and doesn’t spike meaningfully higher, this environment still looks more like consolidation than the start of a deeper risk-off move.

Weekly Poll 🗳️

OpenAI IPO by...?

Last week’s Result:

What industry should I break down next in deep dive?

Most popular answer: Energy⚡️ (75%)

A New way to Earn Income from Real Estate

Commercial property prices are down as much as 40%, and AARE is buying income-producing buildings at rare discounts. Their new REIT lets everyday investors in on the opportunity, paying out at least 90% of its income through dividends. You can even get up to 15% bonus stock in AARE.

This is a paid advertisement for AARE Regulation CF offering. Please read the offering circular at https://invest.aare.com/

Disclaimer: The information provided in this newsletter is for educational and informational purposes only and should not be construed as investment advice. I am not a licensed financial advisor, and the opinions expressed here are based on my personal research and portfolio decisions. Investing in securities involves risk, including the potential loss of principal. Past performance is not indicative of future results. Always do your own research or consult with a licensed financial professional before making investment decisions.