Hey, it’s Summer!

Markets are still rotating, not breaking—and this week the spotlight shifted to a quieter constraint in the AI boom: energy. In this issue, we break down what’s changing beneath the surface and where opportunity may be forming next.

Market Overview — (Dec 15 – 19, 2025)

Price | Weekly Change | |

|---|---|---|

S&P500 | $6,834.50 | -0.14% |

NASDAQ | $23,307.62 | +0.28% |

Dow Jones | $48,134.89 | -0.92% |

10 Year Interest Rate | 4.151 | -0.55% |

Bitcoin | $88,131.73 | -2.30% |

Gold | $4,342.74 | +1.04% |

CBOE Volatility Index | 14.91 | -8.25% |

Data is provided by Google Finance

*Stock data as of market close, cryptocurrency and gold data as of Friday 6:00pm ET

Markets ended the week largely flat with a defensive tilt, as investors digested recent macro signals and headed into year-end with caution. The S&P 500 slipped 0.1%, while the Dow fell nearly 1%, reflecting weakness in cyclicals and industrials. The Nasdaq edged higher (+0.3%), supported by selective strength in large-cap tech, though gains were modest.

In rates, the 10-year Treasury yield eased to ~4.15%, signalling some relief after recent volatility in bond markets. Bitcoin pulled back over 2%, hovering below the $90K level as speculative appetite cooled. Gold continued to grind higher, rising just over 1% as investors maintained hedges against macro uncertainty. Meanwhile, the VIX dropped below 15, reinforcing the view that markets are consolidating rather than entering a risk-off phase.

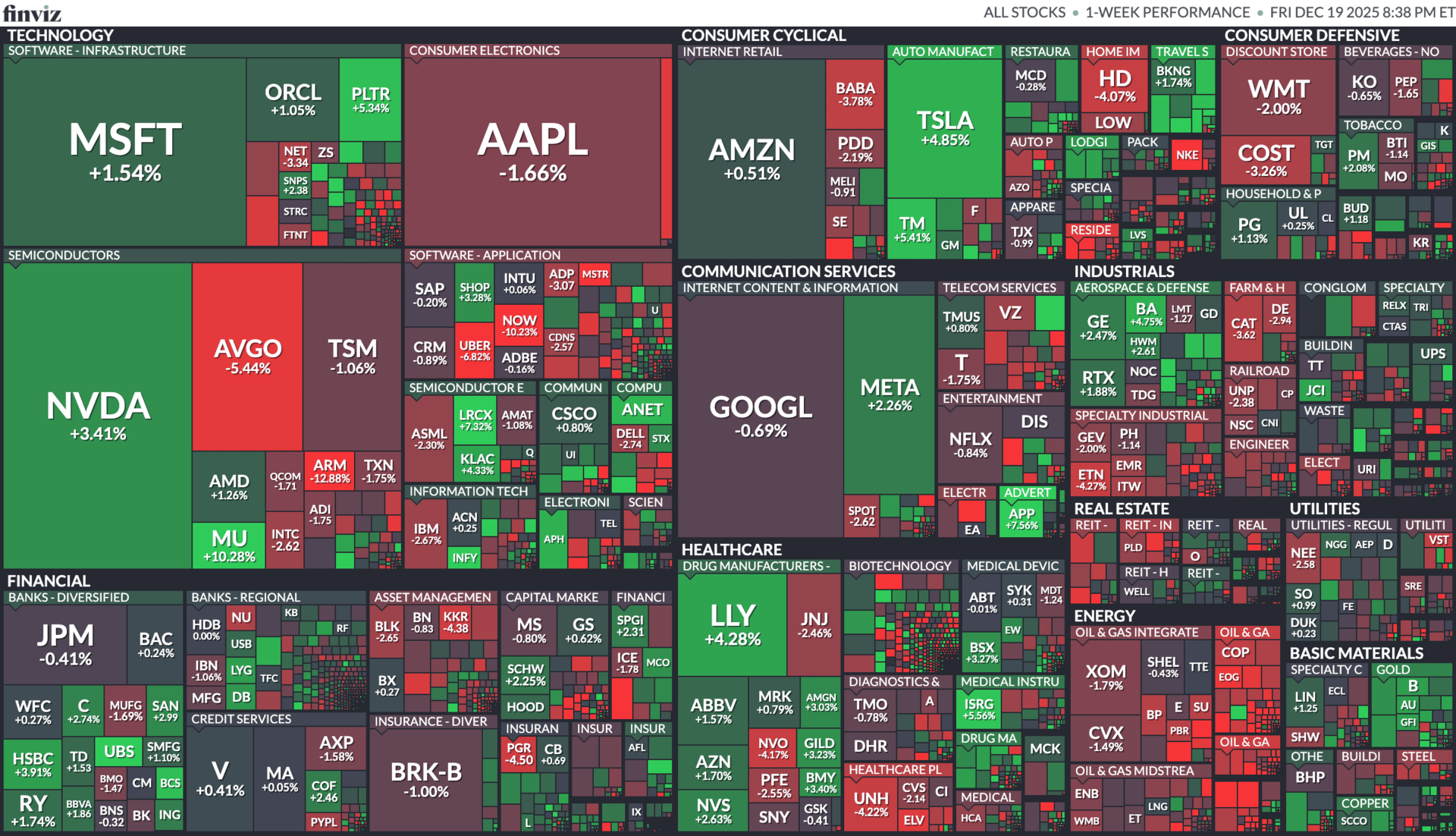

Sector Snapshot

Sector performance this week remained rotational, with investors favouring selective mega-cap tech and healthcare while trimming exposure to more cyclical and AI-infrastructure names. In tech, NVDA (+3.4%) rebounded on dip-buying and position rebalancing, while MSFT (+1.5%) benefited from its more defensive, software-heavy AI exposure. In contrast, AVGO (−5.4%) lagged as markets reassessed the pace of near-term data-centre spending.

Consumer cyclicals were mixed—TSLA (+4.9%) stood out on renewed margin optimism, while AAPL (−1.7%) continued to face questions around near-term growth catalysts. Healthcare remained a bright spot, led by LLY (+4.3%), as investors rotated toward earnings visibility and defensive growth. Financials were largely flat, reflecting easing rate pressure but lingering uncertainty around loan growth.

Overall, the heatmap suggests a market still digesting recent gains, with flows driven more by positioning and relative conviction than by broad risk-off behavior.

What investment is rudimentary for billionaires but ‘revolutionary’ for 70,571+ investors entering 2026?

Imagine this. You open your phone to an alert. It says, “you spent $236,000,000 more this month than you did last month.”

If you were the top bidder at Sotheby’s fall auctions, it could be reality.

Sounds crazy, right? But when the ultra-wealthy spend staggering amounts on blue-chip art, it’s not just for decoration.

The scarcity of these treasured artworks has helped drive their prices, in exceptional cases, to thin-air heights, without moving in lockstep with other asset classes.

The contemporary and post war segments have even outpaced the S&P 500 overall since 1995.*

Now, over 70,000 people have invested $1.2 billion+ across 500 iconic artworks featuring Banksy, Basquiat, Picasso, and more.

How? You don’t need Medici money to invest in multimillion dollar artworks with Masterworks.

Thousands of members have gotten annualized net returns like 14.6%, 17.6%, and 17.8% from 26 sales to date.

*Based on Masterworks data. Past performance is not indicative of future returns. Important Reg A disclosures: masterworks.com/cd

US Markets 🇺🇸

AI boom pushes data-center dealmaking to a record high

Data-centre M&A hit a 2025 record (deal count + dollars), showing how AI compute demand is still driving real capital deployment—even as valuation debates heat up.U.S. reviews allowing advanced Nvidia AI chip sales to China

Washington launched an inter-agency review on Nvidia’s H200 shipments to China; any loosening/tightening here can swing semis sentiment and the broader AI supply chain.Major layoffs across U.S. companies highlight cost cutting pressures — Significant job cuts across tech (IBM, Oracle, Meta), retail (Target, Starbucks), and energy (Chevron, Exxon) reflect cost pressures and automation trends.

Global Markets 🌍

Japan hikes rates to a 3-decade high as Asian markets rally

The BOJ raised rates (with markets watching how far tightening could go), a key driver for yen direction and Japan financials/exportersChina accelerates crude stockpiling as oil price trend softens

China’s buying behaviour matters for the oil complex—faster stockpiling can stabilize demand even when macro headlines look shaky.China extends anti-dumping duties on synthetic rubber from U.S., EU, and South Korea

Duties on a key industrial rubber (used in autos/construction/wiring) stay in place, reinforcing trade friction risk across global manufacturing inputs.Gulf markets rise as oil steadies; Saudi rebounds

Middle East equities firmed with oil stabilizing—important for regional banks, petrochemicals, and consumer-linked plays across GCC markets.

My Take for This Week 📝

One theme that’s becoming harder to ignore is how AI infrastructure is starting to run into real-world energy constraints. Data centers don’t just need chips — they require enormous, continuous power, and recent headlines point to grid capacity, permitting delays, and rising electricity costs as growing bottlenecks. That helps explain why some AI-infrastructure names have struggled recently despite strong long-term demand: the build-out is no longer just a technology problem, it’s an energy one.

Because of that, I’ve started looking more closely at energy stocks and energy-related ETFs, particularly those tied to power generation, grid upgrades, and transitional source like nuclear. If AI investment continues at this pace, energy becomes a critical enabler rather than a background input, and capital will eventually have to flow there to support growth.

Zooming out, this still feels like a market in rotation rather than reversal. Investors are becoming more selective, reassessing what parts of the AI trade are priced for perfection and which parts are still under appreciated. For me, that means staying patient, watching volatility, and looking for opportunities where fundamentals and long-term demand are quietly lining up.

Weekly Poll 🗳️

What's your current outlook on AI stocks?

Last week’s Result:

OpenAI IPO by…?

Most popular answer: After 2026 (50%)

7 Actionable Ways to Achieve a Comfortable Retirement

Your dream retirement isn’t going to fund itself—that’s what your portfolio is for.

When generating income for a comfortable retirement, there are countless options to weigh. Muni bonds, dividends, REITs, Master Limited Partnerships—each comes with risk and oppor-tunity.

The Definitive Guide to Retirement Income from Fisher investments shows you ways you can position your portfolio to help you maintain or improve your lifestyle in retirement.

It also highlights common mistakes, such as tax mistakes, that can make a substantial differ-ence as you plan your well-deserved future.

Disclaimer: The information provided in this newsletter is for educational and informational purposes only and should not be construed as investment advice. I am not a licensed financial advisor, and the opinions expressed here are based on my personal research and portfolio decisions. Investing in securities involves risk, including the potential loss of principal. Past performance is not indicative of future results. Always do your own research or consult with a licensed financial professional before making investment decisions.