Happy New Year!

Markets are starting 2026 with rotation rather than panic, and this week’s moves offer an early look at where capital may be heading next. Let’s break down what’s changing beneath the surface.

Market Overview — (Dec 29, 2025 – Jan 2, 2026)

Price | Weekly Change | |

|---|---|---|

S&P500 | $6,858.47 | -0.83% |

NASDAQ | $23,235.63 | -1.18% |

Dow Jones | $48,382.39 | -0.57% |

10 Year Interest Rate | 4.187% | +1.72% |

Bitcoin | $89,871.93 | +2.61% |

Gold | $4,326.87 | -4.52% |

VIX ( Volatility Index) | 14.51 | -1.16% |

Data is provided by Google Finance & Seeking Alpha

*Stock data as of market close, cryptocurrency and gold data as of Friday 6:00pm ET

Markets opened the new year on a cautious and consolidative note, with all three major U.S. indexes ending the week lower. The S&P 500 fell 0.8 percent and the Nasdaq declined 1.2 percent, as pressure on large cap growth continued, while the Dow Jones held up better, down 0.6 percent, supported by more defensive positioning.

Treasury yields moved higher, with the 10 year yield rising to 4.19 percent, adding pressure to equities and especially to longer duration assets. Bitcoin gained 2.6 percent, holding near the 90,000 level, signalling selective risk appetite rather than broad based risk on behaviour.

Gold pulled back sharply, falling 4.5 percent, as higher yields reduced demand for hedges. Meanwhile, the volatility index stayed subdued near 14.5, reinforcing that this pullback reflects consolidation and rebalancing, not a shift into panic.

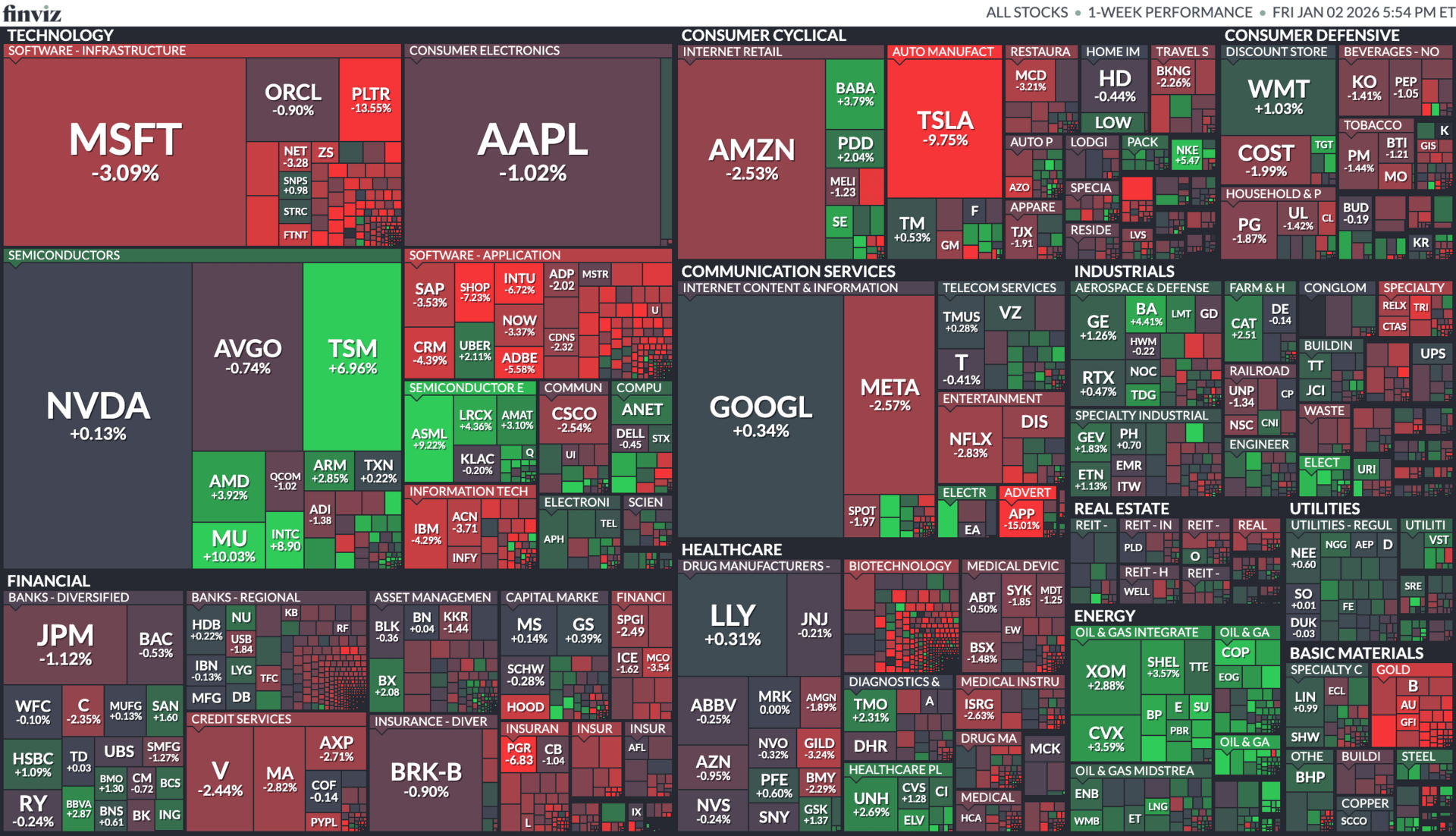

Sector Snapshot

This week’s sector performance leaned risk off, with broad weakness across mega cap tech and consumer cyclicals. Technology lagged as MSFT, AAPL, and AMZN declined, while semiconductors were mixed, with NVDA flat and TSM standing out on strength. Communication services also softened, with pressure on META and NFLX, signalling continued trimming in higher beta growth names.

In contrast, healthcare and energy held up better, providing stability as investors rotated defensively. Financials were mixed, with banks and insurers under modest pressure amid higher yields. Overall, the heatmap reflects a market that is de-risking selectively rather than selling indiscriminately, consistent with early year rebalancing.

Biggest Movers This Week (Market Cap $10B+)

Top Gainers

Micron ( $MU ( ▼ 2.27% ) ) surged 10% as investors rotated back into memory names, betting on improving pricing dynamics and sustained AI-driven demand.

Taiwan Semiconductor ( $TSM ( ▼ 0.04% ) ) climbed almost 7%, standing out among semiconductors as capital flowed toward higher-quality, less speculative AI supply chain exposure.

ASML Holding ( $ASML ( ▼ 0.13% ) ) gained over 9%, supported by renewed optimism around long-term semiconductor capex and its critical role in advanced chip manufacturing.

Top Decliners

Tesla ( $TSLA ( ▼ 0.89% ) ) dropped close to 10%, extending recent weakness as investors reassessed valuation and near-term growth expectations.

Palantir ( $PLTR ( ▼ 0.62% ) ) fell more than 13%, reflecting profit-taking after a strong run and broader pullback in higher-beta AI software names.

Microsoft ( $MSFT ( ▼ 2.09% ) ) slid just over 3%, pressured by early-year rebalancing out of mega-cap tech despite no major fundamental change.

When AI Outperforms the S&P 500 by 28.5%

Did you catch these stocks?

Robinhood is up over 220% year to date.

Seagate is up 198.25% year to date.

Palantir is up 139.17% this year.

AltIndex’s AI model rated every one of these stocks as a “buy” before it took off.

The kicker? They use alternative data like reddit comments, congress trades, and hiring data.

We’ve teamed up with AltIndex to give our readers free access to their app for a limited time.

The next top performer is already taking shape. Will you be looking at the right data?

Past performance does not guarantee future results. Investing involves risk including possible loss of principal.

Markets News

Tesla loses the #1 EV crown to BYD as deliveries miss

Tesla’s weaker deliveries and intensifying competition (plus tax-credit dynamics) hit sentiment—an important read-through for global EV supply chains.OPEC+ likely holds output steady as Saudi–UAE tensions simmer

Oil policy stays tight-rope: oversupply worries vs. geopolitics. This is a key swing factor for energy equities and inflation expectations.Asia index check: Nikkei down while Hong Kong and Korea rally

Early 2026 trading saw Japan’s Nikkei slightly lower while Hong Kong’s Hang Seng jumped; South Korea’s KOSPI also rose on chip strength, classic regional divergence.Energy transition recap: “clean wins, dirty setbacks” in 2025

A year-end look at renewables vs. fossil fuel trends shows the transition story is getting more uneven, policy + financing shifts are driving big sector dispersion.U.S. bonds had a strong 2025, but returns may cool in 2026

Bonds posted their best year since 2020, but Reuters notes 2026 returns may be harder if rate cuts slow and long-end yields stay pressured by debt supply/fiscal risks.

My Take for This Week 📝

This week felt less like panic and more like early year rebalancing, with investors trimming crowded mega cap positions and reallocating selectively. The weakness in large cap tech and consumer cyclicals, alongside resilience in semiconductors like TSM and ASML, reinforces the idea that money is rotating within themes rather than exiting the market altogether.

One narrative I continue to watch closely is AI infrastructure meeting real world constraints, especially energy and grid capacity. The long term AI story is intact, but the pace of deployment is increasingly tied to power availability, permitting, and energy costs. That is why I am starting to pay more attention to energy stocks and infrastructure related exposure, which may quietly benefit as AI demand pushes utilities and generation capacity to expand.

From a market structure perspective, volatility remains contained, with the VIX staying near historically calm levels. As long as volatility stays suppressed, pullbacks like this look more like opportunities to reassess positioning rather than signals to de risk aggressively. For now, I am staying patient, watching where capital rotates next, and focusing on areas with durable fundamentals as the new year unfolds.

Weekly Poll 🗳️

What's your biggest concern for markets in 2026?

Last week’s Result:

Which AI chatbot do you use most often?

Most popular answer: ChatGPT (75%)

Introducing the first AI-native CRM

Connect your email, and you’ll instantly get a CRM with enriched customer insights and a platform that grows with your business.

With AI at the core, Attio lets you:

Prospect and route leads with research agents

Get real-time insights during customer calls

Build powerful automations for your complex workflows

Join industry leaders like Granola, Taskrabbit, Flatfile and more.

Disclaimer: The information provided in this newsletter is for educational and informational purposes only and should not be construed as investment advice. I am not a licensed financial advisor, and the opinions expressed here are based on my personal research and portfolio decisions. Investing in securities involves risk, including the potential loss of principal. Past performance is not indicative of future results. Always do your own research or consult with a licensed financial professional before making investment decisions.